Navy Federal Virginia

Navy Federal Credit Union, often referred to as Navy Federal, is a prominent financial institution with a rich history and a significant presence in Virginia. With a strong focus on serving military personnel and their families, Navy Federal has become a trusted partner for many in the military community. This article delves into the various aspects of Navy Federal's operations in Virginia, exploring its history, services, and impact on the local community.

A Legacy of Service: Navy Federal’s History in Virginia

Navy Federal Credit Union’s roots in Virginia can be traced back to the early 1930s when a group of twelve Navy enlisted men and one officer came together with a shared vision. They sought to establish a financial institution that would provide financial services and support to their fellow service members and their families. This vision led to the founding of the Navy Relief Society’s Credit Union on January 23, 1933, in the Washington, D.C. area.

Over the years, Navy Federal experienced significant growth and expansion. In 1952, it moved its headquarters to the Pentagon, solidifying its connection to the military community. The credit union continued to evolve, and in 1976, it opened its first full-service branch in Hampton, Virginia, marking a significant milestone in its history.

Since then, Navy Federal has established a strong presence in Virginia, with multiple branches and a dedicated workforce serving the state's military population. Its commitment to the region has played a vital role in the financial well-being of countless military families.

Comprehensive Financial Services

Navy Federal Credit Union offers a comprehensive range of financial services tailored to meet the unique needs of military personnel and their families. These services are designed to provide convenience, security, and financial empowerment to its members.

Banking Solutions

Navy Federal provides a wide array of banking services, including checking and savings accounts, certificates of deposit (CDs), and individual retirement accounts (IRAs). Members can access their accounts through a network of ATMs and enjoy competitive interest rates and fee structures.

One of the standout features of Navy Federal's banking services is its commitment to convenience. Members can manage their accounts online, through a mobile app, or via telephone, ensuring accessibility regardless of their location or deployment status.

Lending and Mortgage Options

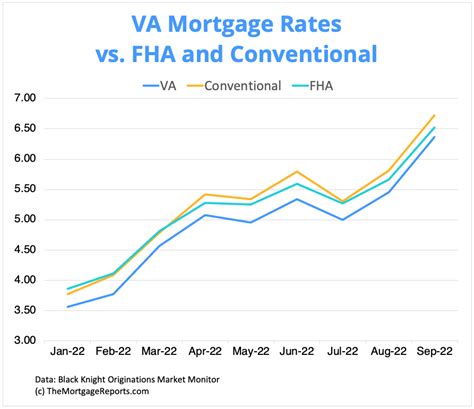

Navy Federal understands the importance of homeownership for military families. As such, it offers a variety of mortgage and lending products, including VA loans, which provide eligible veterans and active-duty service members with favorable terms and low down payment requirements.

Additionally, Navy Federal provides auto loans, personal loans, and credit cards, all of which are designed with competitive rates and flexible repayment options. These lending services aim to support members in achieving their financial goals and managing their finances effectively.

Investment and Retirement Planning

Recognizing the long-term financial needs of its members, Navy Federal offers investment and retirement planning services. Members can access a range of investment options, including stocks, bonds, and mutual funds, to build their financial portfolios. Navy Federal’s financial advisors provide guidance and support to help members make informed investment decisions.

For retirement planning, Navy Federal offers IRAs and employer-sponsored retirement plans, ensuring that members can save for their future and enjoy a comfortable retirement.

Community Impact and Engagement

Navy Federal’s presence in Virginia extends beyond its financial services. The credit union is deeply committed to giving back to the communities it serves, particularly those with a strong military presence.

Community Partnerships

Navy Federal actively engages with local organizations and initiatives to support the well-being of military families and the broader community. It partners with organizations such as the Navy-Marine Corps Relief Society, the Fisher House Foundation, and the Wounded Warrior Project, among others, to provide financial assistance and support to those in need.

Through these partnerships, Navy Federal contributes to various causes, including housing assistance, education initiatives, and programs that promote financial literacy and well-being.

Educational Programs

Understanding the importance of financial education, Navy Federal offers a range of programs and resources to empower its members and the community at large. These initiatives include financial literacy workshops, online resources, and educational materials tailored to different age groups and financial situations.

By promoting financial literacy, Navy Federal aims to help individuals make informed financial decisions, manage their money effectively, and plan for their future with confidence.

Scholarship Programs

Navy Federal believes in investing in the future of military families. Through its scholarship programs, the credit union provides financial support to deserving students pursuing higher education. These scholarships recognize academic excellence and demonstrate Navy Federal’s commitment to supporting the educational aspirations of military-connected students.

Technological Innovation and Digital Services

Navy Federal Credit Union is at the forefront of technological innovation in the financial industry. Its digital services and mobile banking platform have revolutionized the way members access and manage their finances.

Mobile Banking and Digital Tools

Navy Federal’s mobile app and online banking platform offer a seamless and secure experience for members. With features such as mobile check deposit, account management, and bill pay, members can conduct their financial transactions from the convenience of their smartphones or computers.

The app also provides real-time account alerts, allowing members to stay informed about their financial activities and make timely decisions. Additionally, Navy Federal's digital tools include budgeting and savings trackers, helping members stay on top of their financial goals.

Secure Online Transactions

Navy Federal prioritizes the security of its members’ financial information. The credit union employs advanced encryption technologies and multi-factor authentication to ensure that online transactions are safe and secure. Members can trust that their financial data is protected at all times.

Digital Innovation for Military Life

Recognizing the unique challenges faced by military personnel, Navy Federal has developed digital solutions tailored to their needs. These include deployment-friendly account features, such as the ability to temporarily suspend accounts during deployments and resume them upon return. This flexibility ensures that members can manage their finances effectively, regardless of their duty station.

Member Satisfaction and Recognition

Navy Federal’s commitment to excellence and member satisfaction has earned it numerous accolades and recognition. The credit union consistently ranks highly in customer satisfaction surveys, reflecting its dedication to providing exceptional service and financial solutions.

Navy Federal's members appreciate the personalized approach and the credit union's understanding of the unique financial needs of the military community. The positive feedback and loyalty of its members are a testament to the credit union's success in meeting their expectations.

Future Outlook and Expansion

As Navy Federal Credit Union continues to grow and adapt to the evolving financial landscape, its future in Virginia looks promising. The credit union’s focus on innovation, member satisfaction, and community engagement positions it well for continued success.

With a strong foundation in Virginia, Navy Federal is well-equipped to expand its reach and serve an even larger military population. Its commitment to providing accessible and affordable financial services, coupled with its dedication to giving back to the community, ensures that Navy Federal will remain a trusted partner for military families for years to come.

How can I become a member of Navy Federal Credit Union?

+To become a member of Navy Federal Credit Union, you must meet specific eligibility criteria. Membership is open to active-duty military, veterans, DoD civilians, and their families. Additionally, membership is extended to organizations and associations that serve the military community. If you fall into any of these categories, you can apply for membership online or visit a local branch for assistance.

<div class="faq-item">

<div class="faq-question">

<h3>What are the benefits of using Navy Federal's mortgage services?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal's mortgage services offer several benefits to military personnel and their families. These include competitive interest rates, low down payment requirements for VA loans, and flexible repayment options. The credit union's expertise in military lending ensures a smooth and efficient process, making homeownership more accessible and affordable.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does Navy Federal support financial literacy in the community?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal is dedicated to promoting financial literacy through various initiatives. It offers educational programs, workshops, and online resources to help individuals understand personal finance, budgeting, and investing. These resources are accessible to both members and the broader community, empowering individuals to make informed financial decisions.</p>

</div>

</div>

</div>