10 Florida Residents' Guide To Navy Federal Routing Numbers

Understanding routing numbers is crucial for Florida residents who utilize the banking services of Navy Federal Credit Union. These unique identifiers play a vital role in facilitating electronic funds transfers, direct deposits, and various other financial transactions. This guide aims to provide an in-depth exploration of Navy Federal's routing numbers, their applications, and their significance for residents of the Sunshine State.

The Role of Routing Numbers in Modern Banking

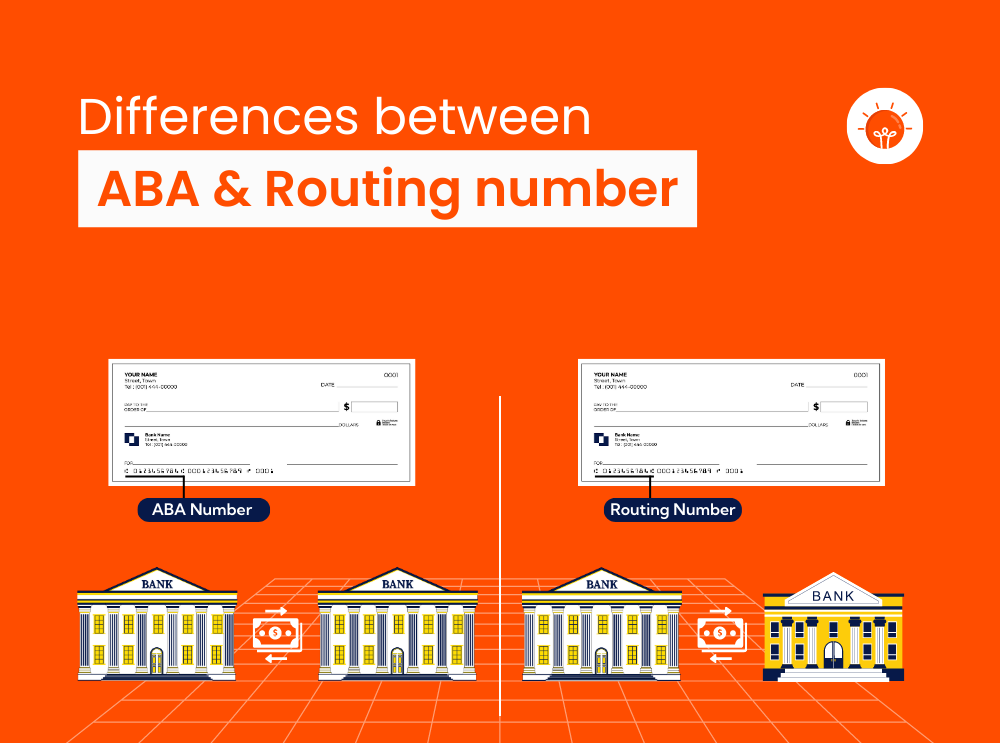

In the realm of modern banking, routing numbers, also known as routing transit numbers or ABA routing numbers, serve as essential tools for identifying financial institutions in the United States. These nine-digit codes are assigned to banks and credit unions by the American Bankers Association (ABA) and are used to ensure the accurate and secure processing of various financial transactions.

Routing numbers are primarily utilized in the following contexts:

- Electronic Funds Transfers (EFTs): When transferring money between different financial institutions, routing numbers are used to identify the origin and destination of the funds.

- Direct Deposits: Employers and government agencies use routing numbers to deposit salaries, wages, and benefits directly into employees' and beneficiaries' accounts.

- Bill Payments: When paying bills electronically, routing numbers are required to facilitate the transfer of funds from your account to the payee's account.

- Automated Clearing House (ACH) Transactions: Routing numbers are crucial for ACH transactions, which include direct deposit, direct payment, and other automated money transfers.

For Florida residents, understanding the routing numbers associated with their banking institution, such as Navy Federal Credit Union, is of utmost importance. This knowledge ensures that they can efficiently manage their financial transactions, whether it's receiving direct deposits, setting up bill payments, or transferring funds.

Navy Federal Credit Union’s Routing Numbers

Navy Federal Credit Union, one of the largest credit unions in the United States, serves a significant portion of the population, including many Florida residents. The credit union utilizes a specific set of routing numbers to identify its various financial services.

The primary routing number for Navy Federal Credit Union is 255074971. This number is used for a wide range of transactions, including:

- General Banking: This routing number is used for everyday banking activities such as check processing, wire transfers, and ACH transactions.

- Direct Deposits: Navy Federal's routing number is essential for employees and beneficiaries to receive their salaries, wages, and government benefits directly into their accounts.

- Bill Payments: When setting up automatic bill payments or paying bills online, the routing number is required to initiate the transaction.

However, it's important to note that Navy Federal Credit Union may use additional routing numbers for specific purposes. These numbers are typically associated with specialized services or geographic regions.

Specialized Routing Numbers

Navy Federal Credit Union may employ different routing numbers for the following scenarios:

- International Wire Transfers: When conducting international wire transfers, a specific routing number may be required to ensure the smooth and accurate processing of the transaction.

- Regional Variations: In some cases, Navy Federal may assign unique routing numbers to specific geographic regions or branches to facilitate localized banking operations.

- Specific Services: Certain services, such as mortgage payments or loan processing, might have dedicated routing numbers to streamline the associated financial transactions.

It's essential for Florida residents who are members of Navy Federal Credit Union to be aware of these specialized routing numbers, as they may be required for specific financial transactions. The credit union typically provides this information on its website, mobile app, or through customer support channels.

How to Find Navy Federal’s Routing Number

Locating Navy Federal’s routing number is a straightforward process. The credit union provides this information on its official website, making it easily accessible to members and prospective customers.

Here are the steps to find Navy Federal's routing number:

- Visit the Navy Federal Website: Go to the official Navy Federal Credit Union website at https://www.navyfederal.org.

- Navigate to the Routing Number Page: Look for a page dedicated to routing numbers or banking information. This page typically provides a clear explanation of the credit union's routing number(s) and their respective uses.

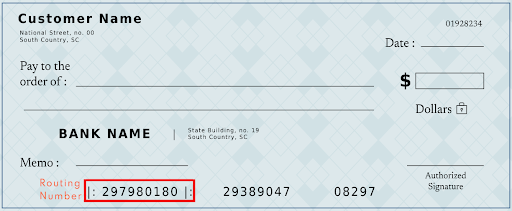

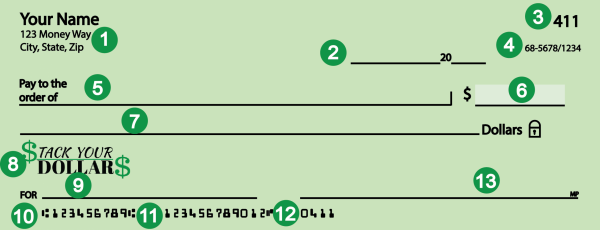

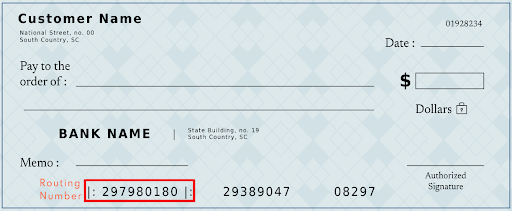

- Check Your Account Documents: If you're a member of Navy Federal, you can find the routing number on your account statements, checks, or other official correspondence from the credit union.

- Contact Customer Support: If you're unable to locate the routing number online or through your account documents, you can contact Navy Federal's customer support team. They can provide you with the necessary routing number for your specific transaction.

It's important to note that Navy Federal's routing number may vary depending on the type of transaction and the specific account you hold with the credit union. Always ensure that you're using the correct routing number for your intended transaction to avoid any delays or errors.

Routing Number Verification and Security

Verifying the authenticity of routing numbers is crucial to ensure the security and accuracy of financial transactions. Navy Federal Credit Union takes the security of its members’ financial information seriously and provides several measures to verify the accuracy of its routing numbers.

Online Verification

Navy Federal’s website offers an online tool for members to verify the routing number associated with their account. This tool typically requires logging into your online banking account and accessing the relevant section for account information or routing numbers.

Phone Verification

Members can also verify the routing number by contacting Navy Federal’s customer support team. The team is trained to provide accurate and up-to-date information regarding routing numbers and can assist with any questions or concerns regarding their use.

Secure Transaction Protocols

Navy Federal employs advanced security measures to protect the integrity of its routing numbers and the financial transactions associated with them. These measures include encryption protocols, secure communication channels, and regular security audits to prevent unauthorized access and fraud.

Future of Routing Numbers: The Shift to ISO 13616 IBAN

As the world of banking continues to evolve, there is a growing trend towards adopting the International Bank Account Number (IBAN) standard, as defined by the International Organization for Standardization (ISO) in ISO 13616. IBAN is an internationally recognized system for identifying bank accounts, and its adoption is expected to streamline cross-border transactions and enhance security.

While the United States has been slow to adopt IBAN, there is a growing recognition of its benefits, particularly in the context of international transactions. Navy Federal Credit Union, being a major player in the financial industry, is likely to adapt to this changing landscape and may eventually transition to using IBAN for certain transactions, especially those involving international wire transfers.

The transition to IBAN would bring several advantages, including improved accuracy in cross-border transactions, reduced errors, and enhanced security. However, it also presents challenges, such as the need for comprehensive education and awareness among both financial institutions and customers to ensure a smooth transition.

Conclusion: The Importance of Routing Numbers for Florida Residents

Routing numbers are an integral part of modern banking, and for Florida residents, understanding and utilizing Navy Federal’s routing numbers correctly is essential for efficient financial management. Whether it’s receiving direct deposits, paying bills, or transferring funds, knowing the appropriate routing number ensures that transactions are processed accurately and securely.

As the financial landscape continues to evolve, staying informed about the latest developments, such as the potential shift to IBAN, is crucial. Navy Federal Credit Union, with its commitment to security and member satisfaction, is well-positioned to guide its members through these changes, ensuring a seamless and secure banking experience.

What is the difference between a routing number and an account number?

+A routing number, as explained earlier, is a unique identifier for a financial institution, while an account number is a specific number assigned to an individual's account within that institution. The routing number helps identify the bank or credit union, while the account number identifies the specific account within that institution.

<div class="faq-item">

<div class="faq-question">

<h3>Can I use Navy Federal's routing number for all types of transactions?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal's primary routing number is typically used for most general banking transactions, including direct deposits and bill payments. However, for specialized transactions like international wire transfers or certain services, dedicated routing numbers may be required. It's important to consult Navy Federal's official resources or customer support for specific guidance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I ensure the security of my routing number and financial transactions?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To ensure the security of your routing number and financial transactions, it's crucial to follow these best practices: Keep your account information, including your routing number, confidential and secure. Avoid sharing sensitive financial details with unverified sources. Regularly monitor your account activity for any suspicious transactions. Utilize strong, unique passwords for your online banking accounts. Enable two-factor authentication for an added layer of security. Stay informed about the latest security measures and best practices recommended by Navy Federal and other reputable financial institutions.</p>

</div>

</div>